- Site Registration

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmers Almanac

- USDA Reports

CMS Energy Earnings Preview: What to Expect

Jackson, Michigan-based CMS Energy Corporation (CMS) operates as an energy utilities company. With a market cap of $22.2 billion, CMS Energy operates through the Electric Utility, Gas Utility, and Enterprises segment, providing electricity and natural gas to millions of residents in Michigan.

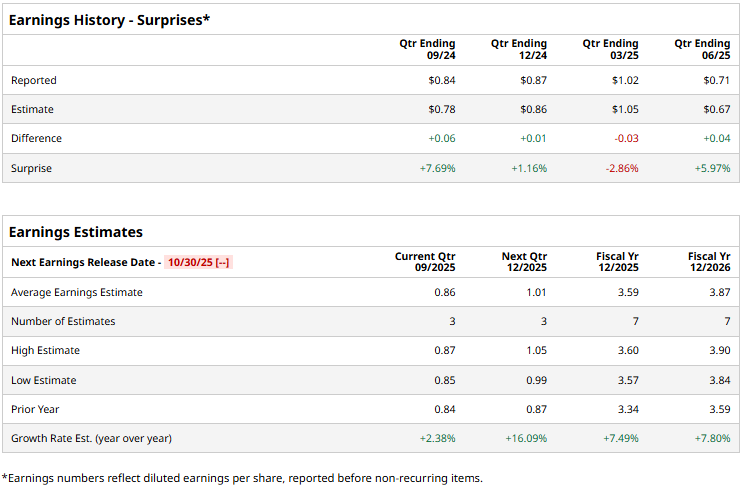

The utilities giant is expected to announce its third-quarter results by the end of October. Ahead of the event, analysts expect CMS to report an adjusted profit of $0.86 per share, up 2.4% from $0.84 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the projections on three other occasions.

For the full fiscal 2025, CMS is expected to deliver an adjusted EPS of $3.59, up 7.5% from $3.34 in 2024. In fiscal 2026, its earnings are expected to further grow 7.8% year-over-year to $3.87 per share.

CMS stock prices have gained 6.1% over the past 52 weeks, notably lagging behind the Utilities Select Sector SPDR Fund’s (XLU) 14.7% surge and the S&P 500 Index’s ($SPX) 14.4% gains during the same time frame.

CMS Energy’s stock prices gained 2.3% in the trading session following the release of its impressive Q2 results on Jul. 31. The company observed a high surge in electric as well as gas utility revenues, and its overall operating revenues soared 14.4% year-over-year to $1.8 billion, beating the Street’s expectations by 8.9%. Further, CMS reached an agreement with a new data center, which is expected to add up to 1 gigawatt of load growth in its service territory, boosting investor confidence.

Meanwhile, the company registered a notable 7.6% growth in adjusted EPS to $0.71, surpassing the consensus estimates by 6%.

Analysts remain optimistic about the stock’s prospects. CMS maintains a consensus “Moderate Buy” rating overall. Of the 16 analysts covering the stock, opinions include nine “Strong Buys” and seven “Holds.” Its mean price target of $78.31 suggests a modest 6.5% upside potential from current price levels.

On the date of publication, Aditya Sarawgi did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.