- Site Registration

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmers Almanac

- USDA Reports

Analysts Warn This 1 Dividend Stock Faces Weak Earnings, High Costs

/Fedex%20Corp%20delivery%20truck-by%20Sundry%20Photography%20via%20iStock.jpg)

FedEx Corporation (FDX) is a global leader in logistics, transportation, and business solutions. It also operates the world’s largest cargo airline and maintains an extensive fleet of more than 200,000 vehicles and nearly 700 aircraft, moving over 16 million shipments daily through express air, ground, freight, and e-commerce services. Serving a diverse customer base, FedEx’s integrated portfolio enables efficient supply chain management and reliable delivery for businesses and individuals worldwide.

Founded in 1971, it is headquartered in Memphis, Tennessee, serving more than 220 countries globally.

FedEx Shows Mixed Performance

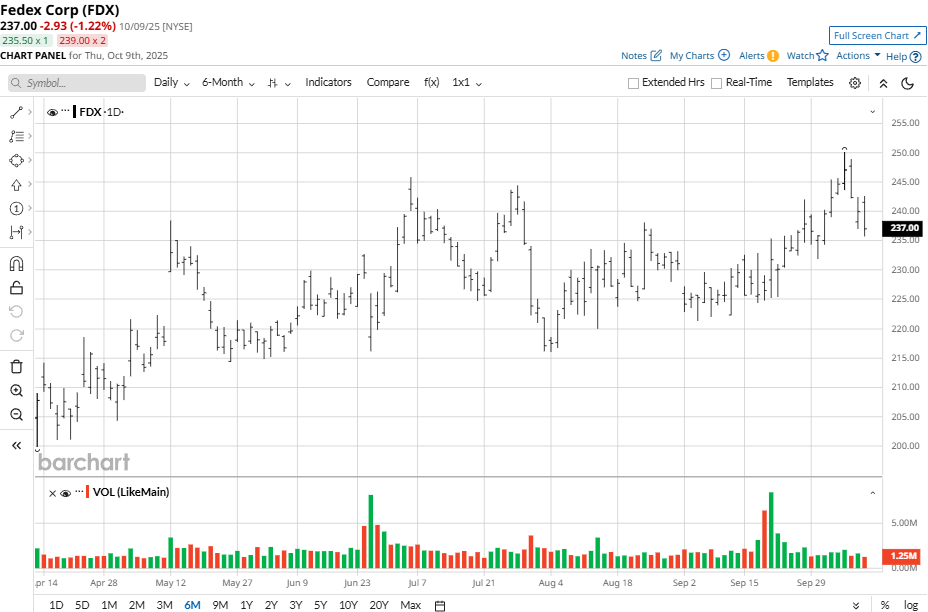

FedEx stock has struggled recently, falling 8.1% over the last five days and 0.3% in the past month. Over the last six months, the stock gained around 9%, although its year-to-date performance remains negative at about 20%, with a 52-week loss close to 15%. Compared to the S&P 500 Index ($SPX), which has gained roughly 14% year-to-date, FedEx has underperformed significantly.

Investors remain cautious amid ongoing macroeconomic uncertainties and pressure in the logistics sector.

FedEx Posted Solid Results

FedEx reported strong fiscal Q1 results on Sept. 18, 2025, surpassing analyst expectations. The company posted adjusted EPS of $3.83, beating estimates of around $3.66, marking a 6.4% year-over-year increase. Revenue reached $22.2 billion, exceeding forecasts near $21.9 billion and reflecting 2.8% growth from the prior year, driven primarily by robust U.S. domestic package volume and pricing strength.

Other key financial metrics showed operating income rising 7.4% year-over-year to $1.3 billion, alongside margin expansion supported by $200 million in transformation savings. Net income was $824 million, up from $794 million a year earlier.

FedEx ended the quarter with $6.2 billion in cash and equivalents, maintaining strong liquidity while repurchasing $500 million in shares and declaring a quarterly dividend of $1.45 per share.

Looking ahead, FedEx reiterated its full-year 2026 guidance with adjusted EPS expected between $17.20 and $19.00, alongside projected revenue growth of 4% to 6%. The company signaled confidence in continued cost optimization and pricing power, while navigating trade headwinds and investment in its network transformation programs.

Analyst Downgrades FedEx

JPMorgan has downgraded FedEx from “Overweight” to “Neutral,” reflecting increasing concerns over risks to the company’s earnings guidance and structural challenges in its freight operations. In its Q3 2025 transportation and logistics sector preview, JPMorgan highlighted that the full-year EPS forecast for FedEx is at risk, as it already factors in a rebound in Freight fundamentals that may not materialize. The bank highlighted the high cost of spinning off the Freight segment and recent operational underperformance.

JPMorgan’s recent industry checks suggest a lower valuation multiple, noting that although pricing discipline remains, it is under pressure and may continue to suppress multiples until volumes improve. The note also cited increasing shipper resistance to higher rates amid growing market capacity, signaling margin pressures for FedEx’s parcel division.

While FedEx’s stock currently trades at a modest premium to its historical average price-earnings ratio, JPMorgan does not expect a re-rating until key structural issues, such as European profitability and negative U.S. mix, are addressed. Their downgrade aligns with a broader cautious stance on transport stocks amid tariffs, trade uncertainties, and subdued trucking rates.

Should You Bet on FDX?

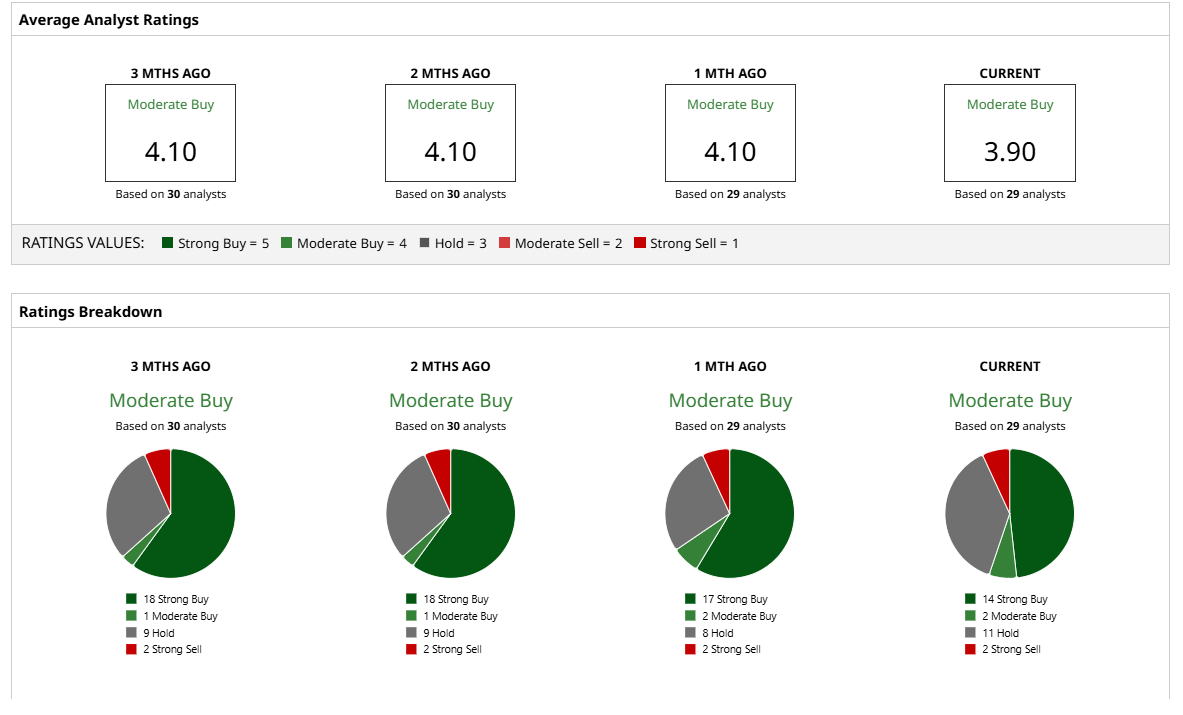

Despite the recent downgrade from JPMorgan, analysts maintain a “Moderate Buy” rating and a mean price target of $264.41, reflecting upside potential of 17% from the current market price.

The stock has been rated by 29 analysts, receiving 14 “Strong Buy” ratings, 2 “Moderate Buy” ratings, 11 “Hold” ratings, and 2 “Strong Sell” ratings.

On the date of publication, Ruchi Gupta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.