- Site Registration

- Mobile Website

- Trading Calendar

- Futures 101

- Commodity Symbols

- Real-Time Quotes

- CME Resource Center

- Farmers Almanac

- USDA Reports

If a Dovish Fed Cuts Rates, These 3 Stocks Could Fly Like Birds

As the old expression goes, “I don’t know it for a fact, I just know it’s true.” And when the Federal Reserve likely cuts rates this Wednesday, as the market expects (with essentially 100% probability), the rumors will be over, and the news will be there to be sold. That’s a take on the old expression, “buy the rumor, sell the news.”

Does that mean the opportunity and the profit-making opportunities are done? Not at all. The soap opera will just be starting.

While the Fed’s next move is baked in the cake, it is far from settled as to what will come next, other than a ton of back-and-forth chatter on financial television. Not to mention on social media.

But that’s to be expected. I’m focused instead on what has been setting up technically in anticipation of this market-moving news from Jerome Powell and company. There’s never a guarantee of a follow-through upside move, of course. But all we can do at times like this is play the percentages.

So, here are 3 tickers I see as follows:

- They have daily chart patterns that imply that there’s buying strength behind them.

- Their Barchart Opinion scores are such that they are less likely to break down hard without a fight.

- The Fed lowering rates potentially positions them to go from “setup conditions” to “buying conditions,” once the market’s first 24 hours post-Fed news conference has passed. In my experience, there’s a lot more volatility from mid-day Wednesday through mid-day Thursday, when the shock value of the day’s events are starting to fade.

One big assumption I’m making is that when the rate cut is announced, the stock market will do what it has conditioned itself to do: act like the Fed controls longer-term interest rates, when in fact it does not. The Fed sets overnight lending rates, more likely to impact your T-bill holdings, CDs, and market accounts than a 10-year bond.

However, someone forgot to tell that to the algorithms! You know, the ones that have much greater sway over what happens to our stock market wealth than corporate earnings, or even what the Fed does. This week is all about the market’s reaction, which is what occurs based on its interpretation. That is aided heavily by Wall Street analysts and macro pundits. In other words…

Let’s Go to the Charts, Since They Tend to Tell the Story Best!

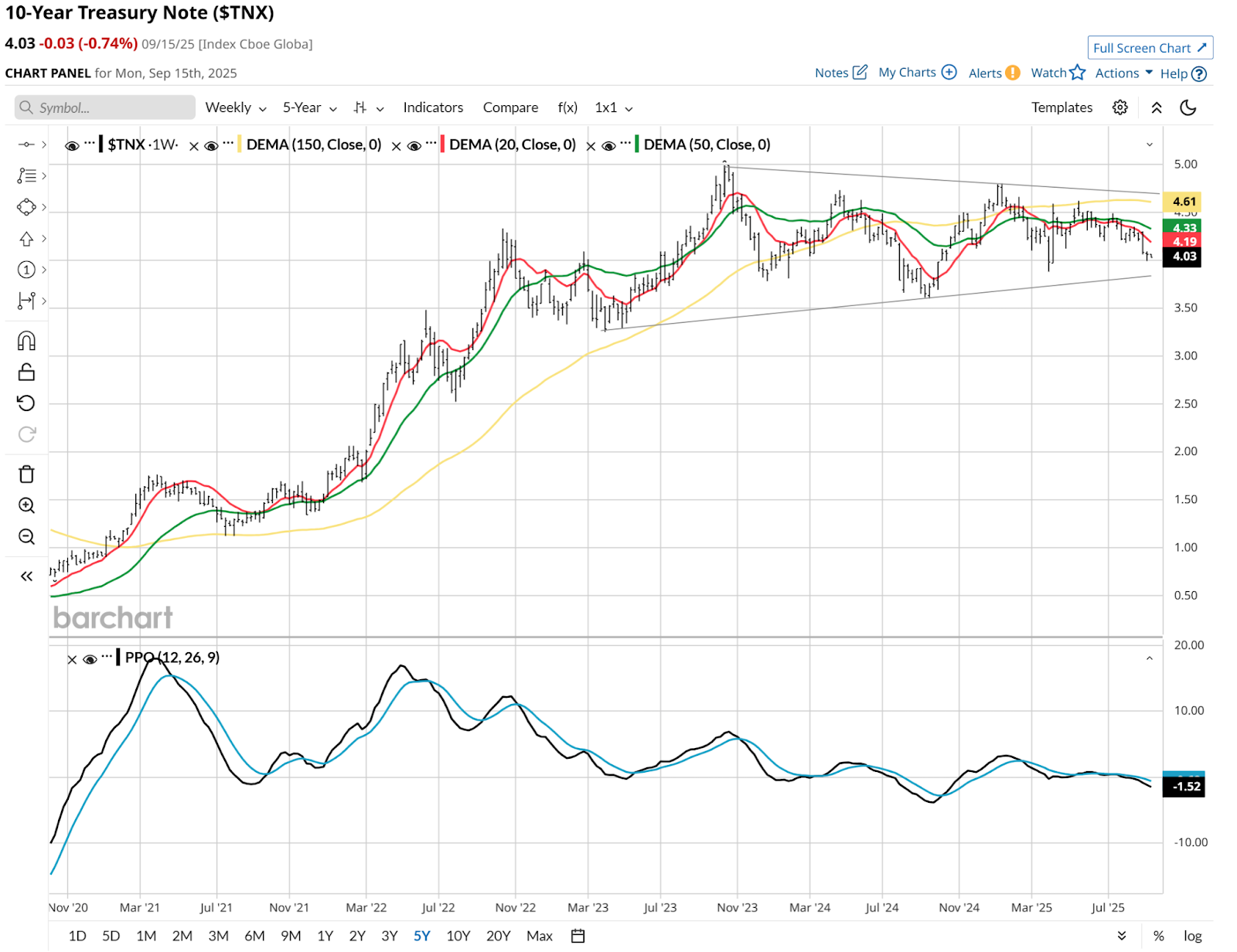

The 10-year bond rate is ever so close to breaking down. That is, rates dropping below 4% meaningfully, for the first time in more than 2 years. I’ve tracked this here for you before, and those very thin lines forming a trend channel in the top section of the chart are reaching decision time. Just like the Fed.

The reaction of stocks in the aggregate will have a lot to do with how the 10-year yield behaves. That’s the rate that mortgages and many other big-money loans are based on. So there’s a trickle-down effect to consumer behavior and buying power, as well as the ability for corporations to borrow at favorable rates to keep growing revenue and earnings.

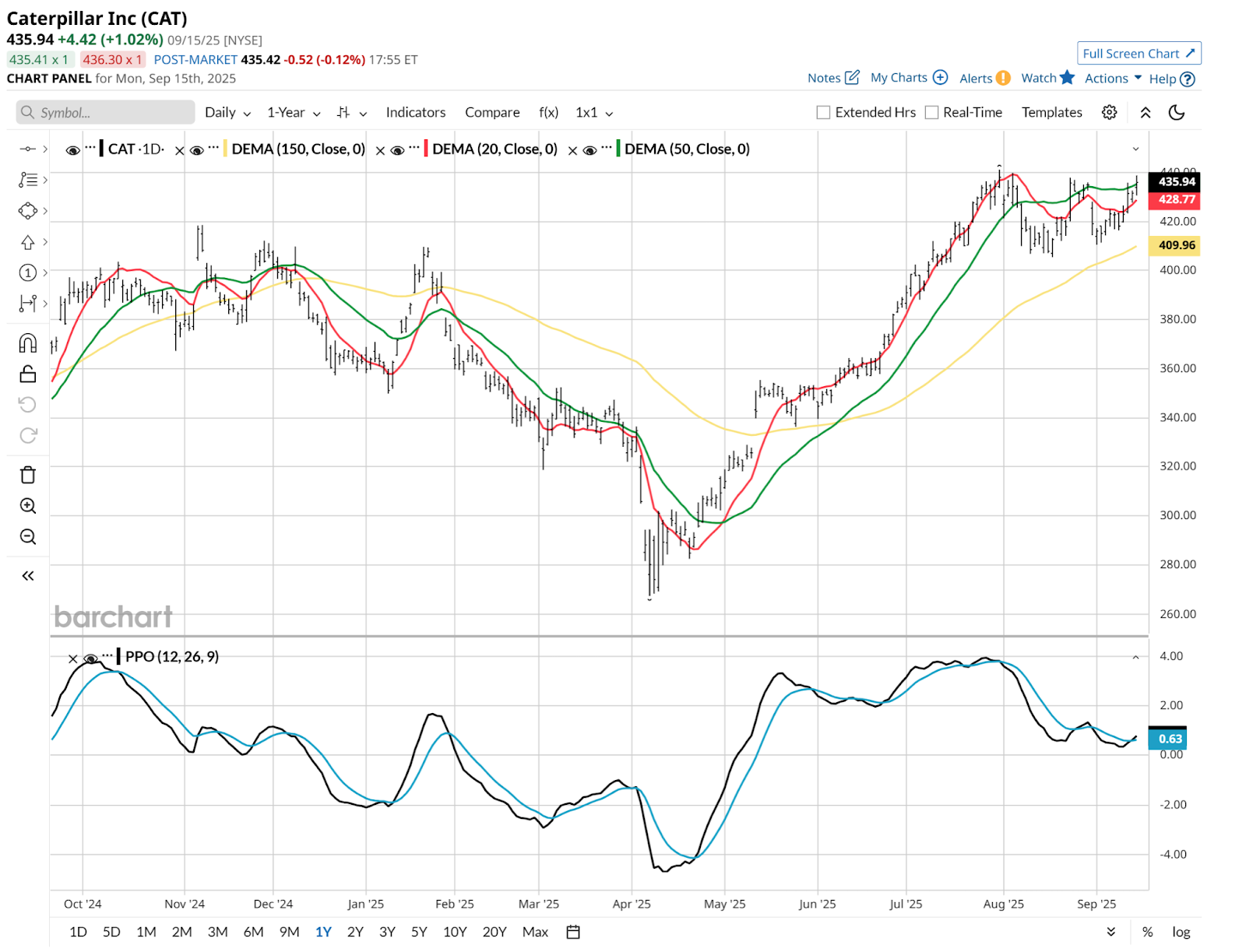

Stock to Watch #1: Caterpillar

Caterpillar (CAT) thrives on spending by big industry, and it provides its own financing to customers who need it. If those rates dip, it is poised to see its lending division get busier, as business increases. The chart shows a stock meandering the past couple of months after a mighty move. It is so close to breaking out. Ah, but the Fed’s decision might be the tipping point.

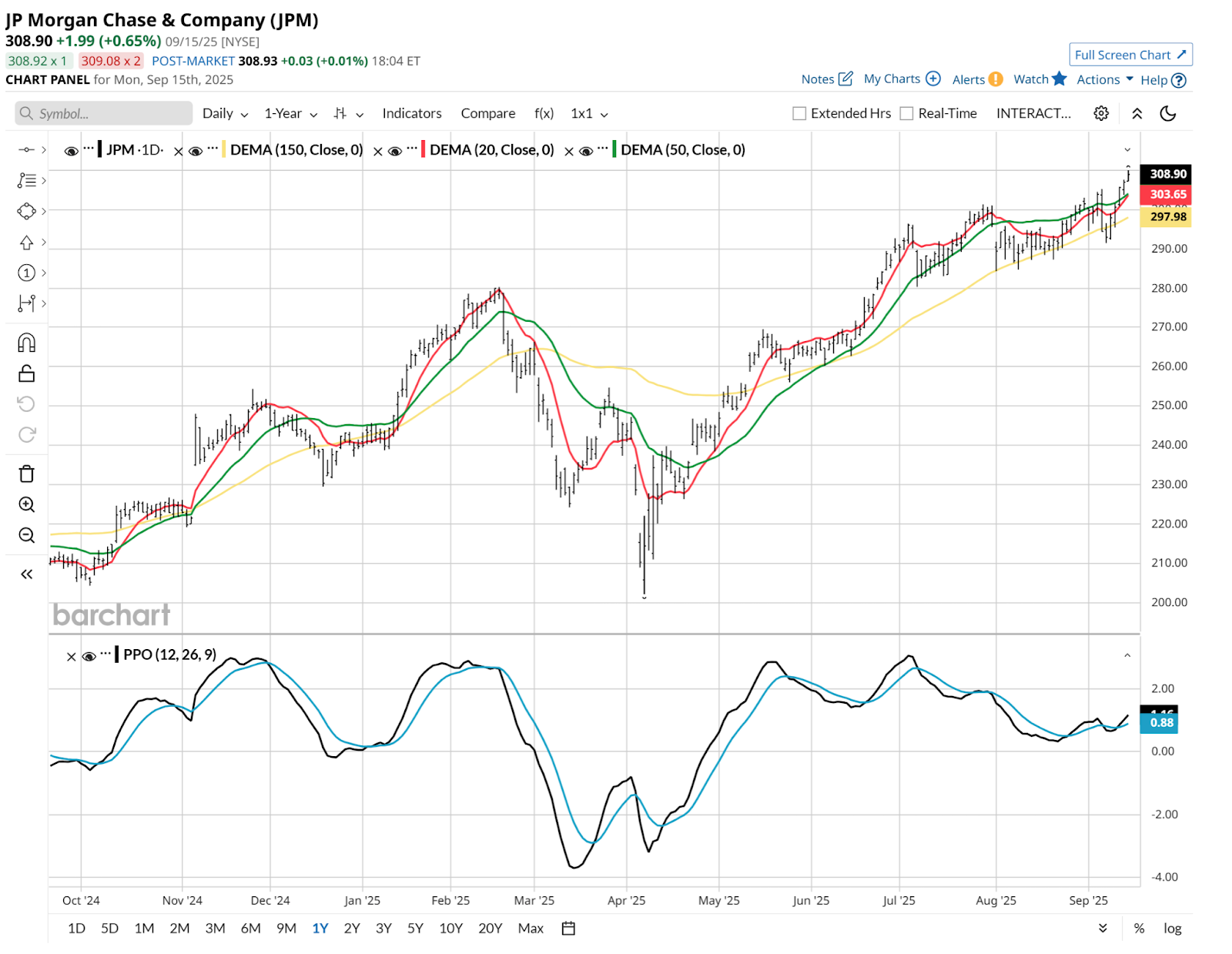

Stock to Watch #2: JPMorgan Chase

JPMorgan Chase (JPM) is a giant bank with a giant brokerage and investing business. So we don’t need CEO Jamie Dimon to tell us that lower rates should help this sector, and the bigger stocks within it. That said, the one way that this logic can go awry is if the bond market rejects the drop in rates, and pressures the 10-year yield higher.

If big bond holders view the combination of Fed easing and the continuation of government reluctance to cut spending negatively, that could mess this all up. But for now, the chart points higher, and seems to be anticipating good news from the Fed. That’s a breakout right there. If it can keep it.

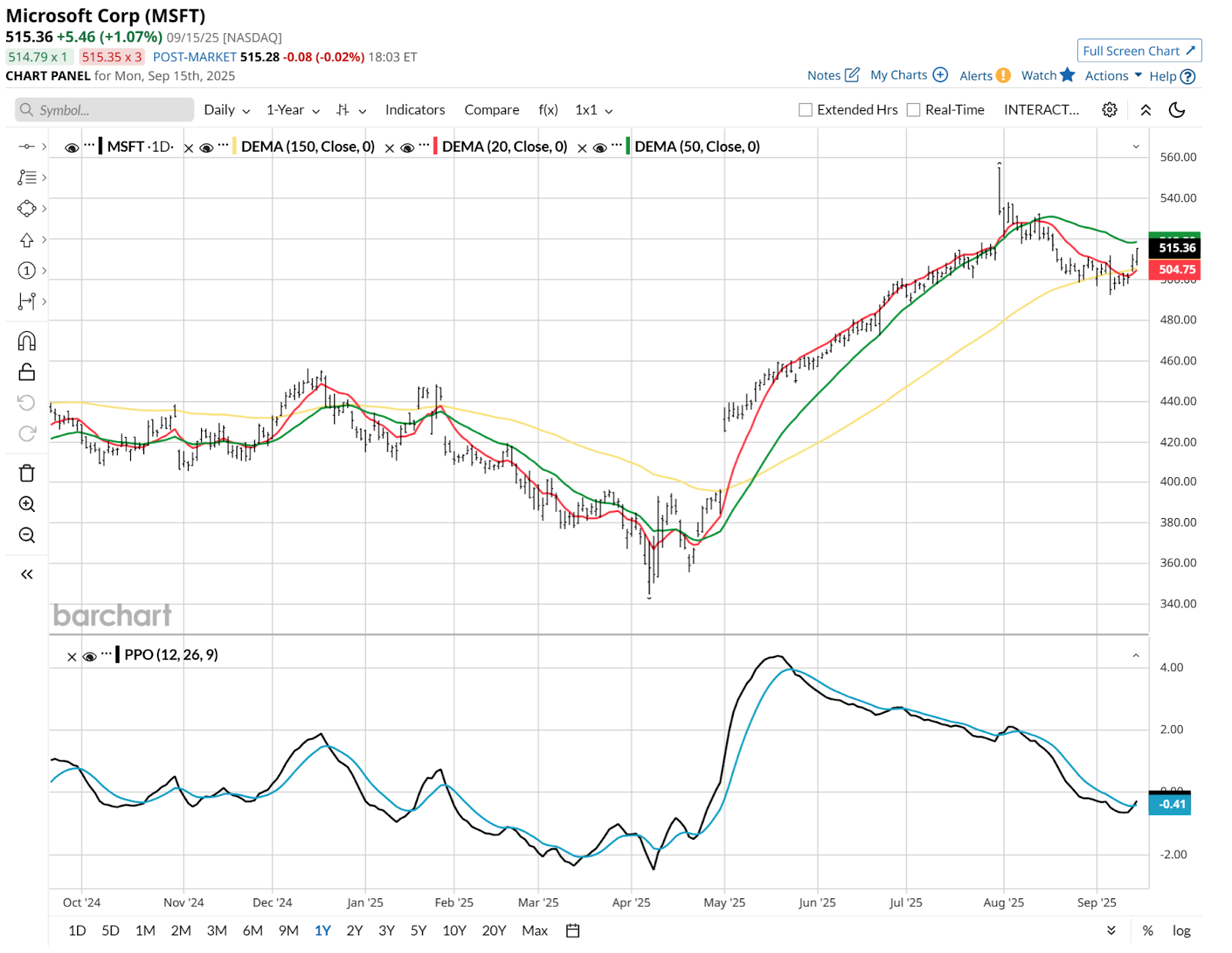

Stock to Watch #3: Microsoft

Microsoft (MSFT)? What’s Microsoft doing in this trio? How is this multitrillion-dollar stock impacted by what the Fed does?

Answer: It isn’t. MSFT has a AAA credit rating, which is higher than that of the U.S. government. So “Mr. Softee” can finance itself. But if the Fed loosens monetary policy, the stout MSFT could benefit from its customers’ increased ability and willingness to buy its products and services. The stock rallied on earnings last time around, reached the $560 area, and promptly fell back 10%. Re-rallying on a Fed move is not far-fetched here.

Popcorn, Powell and Pundits: Here We Go

OK, it’s not exactly the Emmys or even the Tony awards. But Fed announcements and the post-meeting Q&A are now must-see TV for traders, at least so they can measure for themselves to what degree those events will impact their portfolios, and for how long.

It didn’t used to be this way. Fed day used to be just any other day. But that was way back before phones in our pockets, and computer screens that did more than allow us to type and maybe add some numbers. For some it’s the same game they’ve always known, while for others, it’s a completely new world. And we’re using our experience to try to profit from it, at every turn.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.